CIOE Information and Communication Exhibition focuses on chip, material, device, module, equipment, scheme and other whole industry chain segments, serves the data center and telecom market in an all-round way, and focuses on building professional platforms for communication chip manufacturers, device manufacturers, equipment manufacturers, engineers, operators, Internet and other enterprises.

Catalogue:

Definition and Classification of Fiber Optic Industry

Development history of the fiber optic industry

Policy Environment for Fiber Optic Industry

Barrier to entry in the fiber optic industry

The fiber optic industry industry chain

Current situation of the fiber optic industry

Advantages and disadvantages of the development of the fiber optic industry

The competitive landscape of the fiber optic market

Development Trends in the Fiber Optic Industry

——Definition and Classification of Fiber Optic Industry

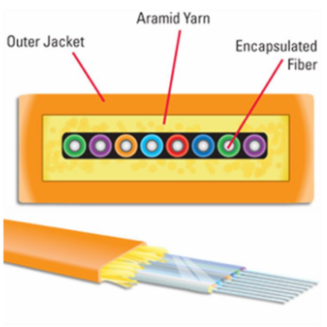

Fiber optic, abbreviated as optical fiber, is a medium for transmitting light beams, consisting of a core layer, a cladding layer, and a coating layer. Fiber optic cables have significant advantages such as large communication capacity, long relay distance, good confidentiality, and strong adaptability. Therefore, they are widely used in the communication industry and are the main component of making optical cables.

According to their composition, optical fibers can be divided into quartz optical fibers, fluorinated optical fibers, and plastic optical fibers; According to the fiber profile, it can be divided into step type fibers and gradient type fibers; According to the transmission mode, it can be divided into multimode fiber and single-mode fiber; According to the working wavelength, it can be divided into short wavelength fibers and long wavelength fibers.

Fiber optic classification

Fiber optic can be divided into two types based on the transmission mode of light in the fiber: single-mode fiber and multi-mode fiber. The so-called “mode” refers to the transmission path of light entering the optical fiber at a certain angular velocity. Due to the difference in core diameter, the number of transmission modes in optical fibers also varies. Single mode fiber refers to a fiber with a smaller core diameter that allows only one mode of light propagation. Single mode fiber has a large bandwidth, long communication distance, and high requirements for light sources. Multimode fiber refers to a fiber with a larger core diameter that allows light to propagate in multiple modes. Multimode fiber has a narrow bandwidth, short communication distance, and low requirements for light sources.

The main differences between single-mode fiber and multimode fiber

——Development history of the fiber optic industry

Since 1977 when China developed its first short wavelength, step type fiber optic cable using self-made equipment, the development of China’s fiber optic cable industry has officially begun. With the layout of China’s telecommunications network starting in the 1990s, the demand for fiber optic cables has greatly expanded. In order to break free from the market control of foreign enterprises’ fiber optic cable products, China’s self-developed path of fiber optic cable technology has also begun. So far, the development of China’s fiber optic industry has gone through four stages: initial stage, deployment stage, high-speed development stage, and fiber optic household entry stage.The Development History of China’s Fiber Optic Industry

——Policy Environment for Fiber Optic Industry

In recent years, the Chinese fiber optic industry has received high attention from governments at all levels and key support from national industrial policies. The country has successively introduced multiple policies to encourage the development and innovation of the fiber optic industry. Policy plans such as the “14th Five Year Plan for National Informatization”, “14th Five Year Plan for Promoting Agricultural and Rural Modernization”, “14th Five Year Plan for Digital Economy Development”, and “Overall Layout Plan for Digital China Construction” will promote China’s network construction and communication infrastructure construction, thereby promoting the development of the fiber optic industry and providing a good production and operation environment for enterprises.

——Barrier to entry in the fiber optic industry

Technical barriers

The core of optical fiber lies in optical fiber preforms, and the design and production technology of optical fiber preforms have a high threshold. Only a few Japanese, American, European, and Indian companies truly master the design and production technology of core optical fiber preforms; In recent years, although some Chinese companies have acquired some technology through cooperation with foreign-funded enterprises, it is difficult and high for potential competitors to find suitable partners to introduce technology and conduct independent research and development.

Financial barriers

In the fiber optic industry, the manufacturing workshop of fiber optic preforms and the construction of fixed assets such as fiber optic drawing towers require large-scale investment and have a high funding threshold. Potential competitors need strong financial support and corresponding economies of scale in order to compete effectively with existing enterprises in the market that have mastered independent research and development technology.

Brand and customer resource barriers

The majority of demand in the Chinese fiber optic cable market comes from the three major state-owned telecommunications operators, who have established a standardized centralized procurement bidding system, which gives suppliers with superior scale and successful bidding experience an advantage in winning bids. In addition, the three major state-owned telecommunications operators have also established a comprehensive post evaluation system to track the product quality of suppliers for a long time, and comprehensively evaluate the supplier’s ability to provide products and solutions, engineering quality, operation and maintenance capabilities, and other aspects.

——The fiber optic industry industry chain

The upstream of the fiber optic industry mainly includes fiber optic preforms (quartz pipes, germanium tetrachloride, silicon tetrachloride), fiber optic coatings, PE materials, and other fiber optic raw materials and manufacturing equipment production industries. The prosperity of upstream industries not only affects the stability of fiber optic product supply, but also affects product quality, production costs, and product differentiation. The impact of changes in upstream industries on China’s fiber optic industry is mainly reflected in the following two aspects: (1) Further improvement in the production level of upstream industry products will promote the improvement of fiber optic product quality and the reduction of production costs; The production of optical fibers requires strict requirements for the purity, geometric dimensions, and accuracy of raw materials such as quartz pipes, silicon tetrachloride, germanium tetrachloride, and optical fiber coatings. Therefore, the improvement of raw material production processes and technological levels will promote the development of the optical fiber industry. (2) The increase in competition in the upstream industry helps to enhance the bargaining power of the fiber optic industry. The gradual increase in the number and level of competition among upstream suppliers of raw materials such as quartz pipes and coatings will enhance the bargaining power of fiber optic industry manufacturers in procurement, thereby promoting the healthy development of the entire fiber optic industry.

The downstream terminal applications of optical fibers mainly include the information industry and other industries, such as medical lasers and sensing energy transmission. The changes and development of downstream industries will have a significant impact on the demand for fiber optic cables: the three major state-owned telecommunications operators will accelerate the construction of information networks, such as 5G, FTTx and other projects, in order to enhance market competitiveness, thereby bringing about a demand for fiber optic products; The increasing maturity of technologies such as the Internet of Things and cloud computing, as well as the expansion of application areas, will drive the development of the domestic information industry, thereby driving the demand for fiber optic products; In recent years, the gradual maturity of emerging industries such as medical lasers, military sensing, communication security, and smart grids will drive the demand for fiber optic products.

Industry Chain Structure of Fiber Optic Industry

Fiber optic preforms are cylindrical high-purity quartz glass rods, with the central part (i.e. core rod, also known as core layer) being a glass material with a higher refractive index, and the surface part (i.e. cladding) being a glass material with a lower refractive index. The diameter of fiber optic preforms ranges from tens of millimeters to 210 millimeters, and they are one meter to several meters long. A single fiber preform can be used to produce thousands of kilometers of optical fibers. The quality of fiber optic preform products varies greatly depending on the purity and quality of the raw materials used, as well as the precision of the technology and production process used. The quality of finished optical fiber preforms also has a significant impact on the quality and characteristics of optical fibers, such as purity, tensile strength, effective refractive index, and attenuation.

Data shows that in 2022, China’s production of optical rods was 13103.33 tons, with an import volume of 250.7 tons and an export volume of 1851 tons, resulting in a demand of 11503.03 tons. The development direction of fiber optic preforms is complementary to the development of fiber optic cables. At present, the development of fiber optic preforms is mainly divided into the following two directions. Firstly, with the increasing demand for fiber optic performance in the market, manufacturers can improve the structure and performance of fiber optic preforms to meet the market’s requirements for fiber optic performance; Secondly, manufacturers are continuously developing towards large-scale production, further improving product production efficiency and fiber preform drawing efficiency through innovative product production technologies. In the future, the development trend of optical fiber preforms is expected to continue to focus on improving the performance of optical fibers and increasing the production efficiency of optical fiber preforms.Supply and demand balance of China’s fiber optic preforms from 2014 to 2022

——Current situation of the fiber optic industry

China has built the world’s largest and technologically advanced fiber optic broadband and mobile communication network. In recent years, benefiting from the overall network construction of the country and the development of the digital economy, the construction of the “dual gigabit” network has driven the stable growth of domestic demand for fiber optic cables. Data shows that in 2019, the demand for China’s fiber optic industry reached 273 million kilometers, and by 2022, the demand for China’s fiber optic industry has reached 356 million kilometers.

The demand situation of China’s fiber optic industry from 2015 to 2022

The fiber optic industry, as an important intermediate link in the fiber optic industry, saw a significant drop in product prices in 2019, and the scale of the domestic fiber optic industry almost halved, with an annual scale of 13.94 billion yuan; In 2020, the scale of the domestic fiber optic market shrank to 11.252 billion yuan, and in 2022, the scale of China’s fiber optic market rebounded to around 14.604 billion yuan.

——Advantages and disadvantages of the development of the fiber optic industry

Favorable factors

(1) Support from industrial policies

In recent years, many important policy documents have mentioned strengthening the construction of network infrastructure such as gigabit fiber optic. For example, in March 2021, China released the “Dual Gigabit” Collaborative Development Action Plan (2021-2023) “, which proposed that by 2023, China’s gigabit optical network coverage of households should reach 400 million, with 10 million passive optical network ports and 30 million gigabit broadband users.

(2) The intensification of market competition and industry integration

In the fierce competition in the fiber optic industry, manufacturers with integrated production capabilities of rod and cable have obvious competitive advantages. In addition, the concentration of the fiber optic industry is expected to continue to increase, which is of positive significance for reducing redundant production capacity and maintaining an orderly and healthy market environment.

(3) Improvement of technical level

After years of development, the technological level of China’s fiber optic industry has significantly improved. Some domestic manufacturers have mastered the research and development capabilities and production technology of fiber optic preforms and fibers, and have the ability to compete with international fiber optic preform and fiber optic manufacturers, ensuring the stability of supply in the domestic fiber optic industry.

(4) The development of international cooperation

In recent years, international fiber preforms and fiber manufacturers with advanced technology have adopted a cooperation model with domestic enterprises to enter the Chinese market. Through this international cooperation model, leading domestic fiber optic industry manufacturers have gradually mastered core fiber optic preforms and fiber optic production technology, enhancing their competitiveness.

Adverse factors

(1) The challenges of international development

Internationalization is one of the important directions for the development of China’s fiber optic industry. How to follow the “the Belt and Road” strategy, complete the layout of important markets in Southeast Asia and Africa with high efficiency and quality, and localize management, production and sales talents in overseas markets are the main challenges for enterprises to carry out international development.

(2) Competition among internationally mature enterprises

Most foreign manufacturers in the fiber optic industry have completed the global fiber optic production capacity layout, and have strong localized production and marketing service capabilities in some overseas regions. In the situation of tight product supply, it has outstanding advantages in delivery time and logistics costs, and strong competitiveness.

(3) The relative shortage of technical talents

The continuous improvement of the production process for optical fiber preforms has put forward high requirements for the depth and breadth of the technical level of R&D personnel. Due to the immaturity of fiber optic preform production technology in China, there is a relative shortage of high-quality composite talents and marketing service personnel who have mastered relevant technical foundations in related fields, which to some extent restricts the development of the fiber optic industry.

——The competitive landscape of the fiber optic market

There are over 60 global fiber optic manufacturers, of which about half are Chinese enterprises. Due to the large number of optical communication users and sustained strong market demand in China, as well as the long-term protection of high-tech enterprises in the fiber optic industry by national policies, domestic enterprises are currently in a rapid development trend. In recent years, with the gradual release of policy dividends such as national “three network integration”, “broadband China”, and 4G/5G construction, the technological research and development strength of industry leading enterprises has been significantly improved.

State owned enterprises: Large state-owned enterprises represented by Changfei Fiber Optics and Zhongtian Technology provide fiber optic cable products and solutions to downstream telecommunications operators in the industry. These large state-owned enterprises rely on their strong resource, brand, and financial advantages to layout the fiber optic cable industry. Large state-owned enterprises such as Changfei Fiber Optics and Zhongtian Technology have strong R&D capabilities in their products, and they have independently developed and mastered the independent intellectual property rights of high profit hardware products, such as optical fiber preforms. In order to expand diversified business models and service scope, enhance the comprehensive competitiveness of state-owned enterprises, on the one hand, they increase their business content through acquisitions or mergers, and on the other hand, they rely on their own advantages in funding and brand awareness to expand their product coverage in overseas markets.

Private enterprises: Represented by enterprises such as Hangzhou Futong, Tongding Internet, and Jiangsu Hengtong, private enterprises have formed a comprehensive manufacturing system with their technological strength, as well as a complete industrial chain covering the production of rods, fibers, and cables. Compared to state-owned enterprises, private enterprises have weaker resource and financial strength, but their cost control ability and product research and development advantages are prominent, and they have strong competitive advantages in regional markets or some products.

Joint ventures and pure foreign-funded enterprises: Sino foreign joint ventures represented by companies such as Terence, Pressman, and Xigu Guangtong, including joint ventures and pure foreign-funded enterprises. This type of enterprise has prominent advantages in managing funds and technology, emphasizing resource allocation and enterprise management level, and has strict control over product quality.

Top 10 Most Competitive Global Fiber Optic Cable Enterprises in 2022

In 2021, the production of China’s fiber optic industry was 339 million core kilometers, while the production of Tongding Interconnected Fiber was 6.281 million core kilometers, accounting for 1.85%; Futong Information has a production capacity of 18.667 million core kilometers, accounting for 5.5%; Jiangsu Zhongli has a production capacity of 4.6337 million core kilometers, accounting for 1.37%; Kaile Technology’s fiber optic production is 9.6941 million core kilometers, accounting for 2.86%.

Production concentration of Chinese fiber optic industry enterprises in 2021

*Source: Intelligence Research Consulting Compilation

Development Trends in the Fiber Optic Industry

Good development prospects

With the development of 5G and the accelerated arrival of 6G era, and the rapid development of the Internet industry, the global demand for optical fiber products will gradually increase. In order to adapt to the development of the times, Chinese fiber optic enterprises will continuously undergo industrial transformation and product upgrading. In recent years, the coverage of fiber optic broadband in the world has rapidly increased, which has made China more deeply aware of the importance of fiber optic communication, and the future development of fiber optic is promising.

Accelerate international market layout

Economic globalization has brought many opportunities to China’s economic market. In the early stages of economic globalization, the Chinese government advocated “going out”. In the critical period of China’s social transformation, the “Belt and Road” has become the most important guiding theory for the development of industries such as economy, culture, and technology in China. Under the guidance of the Belt and Road Initiative, more enterprises and industrial technologies in China have the opportunity to expand overseas, and the fiber optic industry can also complete industrial upgrading and transformation with policy support, accelerating the pace of going global. Some enterprises in the current fiber optic industry have already entered the world’s advanced industry, and their products cover various regions around the world.

Data centers and submarine cables drive new growth

In addition to the steady development of the Internet, submarine cables and data centers will also promote the further development of the fiber optic industry. Most of the international communication worldwide is completed by submarine optical cables, while the development process of submarine cables in China is still relatively short and is expected to become a new industry growth point in the future. At the same time, starting from the 14th Five Year Plan, the application of data in China has gradually received attention, and the Internet of Things cannot do without the construction of data centers. The construction of data centers requires the assistance of a large number of high-performance optical cables, which will continuously promote the research and development level of the fiber optic industr Accelerated research and development of fiber optic preformsTo completely break free from the oppression of foreign enterprises